Introduction

Managing business payments can be stressful, slow, and full of errors when done manually. This is why many companies are now switching to AP automation software.

It helps businesses handle their accounts payable work faster, safer, and with better control.

In this complete guide, you will learn what AP automation software is, how it works, its benefits, and why it is becoming essential for modern businesses.

What Is AP Automation Software?

AP stands for Accounts Payable. It refers to the money a business owes to its suppliers, vendors, and service providers.

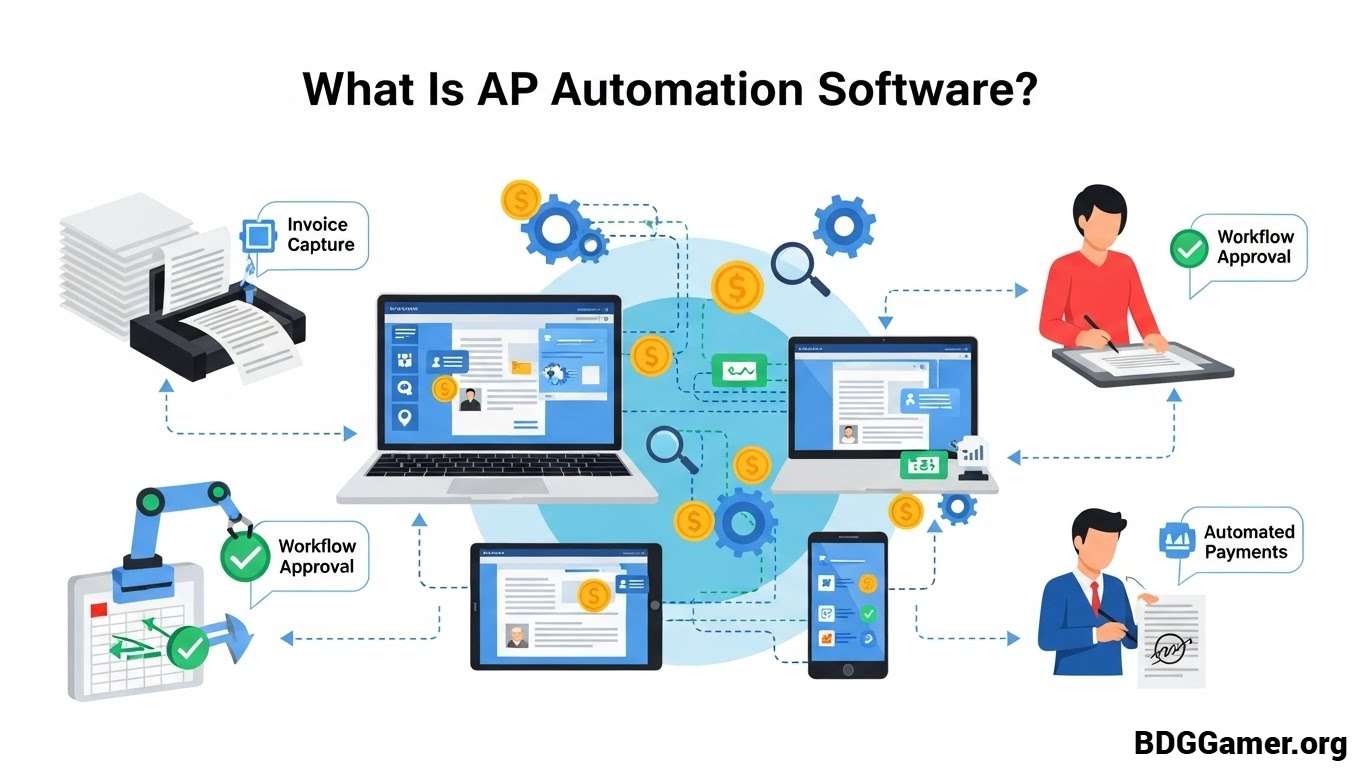

AP automation software is a digital system that manages the full accounts payable process. Instead of entering invoice data manually, sending paper checks, and tracking approvals by email, the software does everything in one organized system.

It helps businesses:

- Receive invoices

- Capture invoice details

- Match invoices to purchase orders

- Get approvals

- Schedule payments

- Keep records safe

Why AP Automation Software Is Important

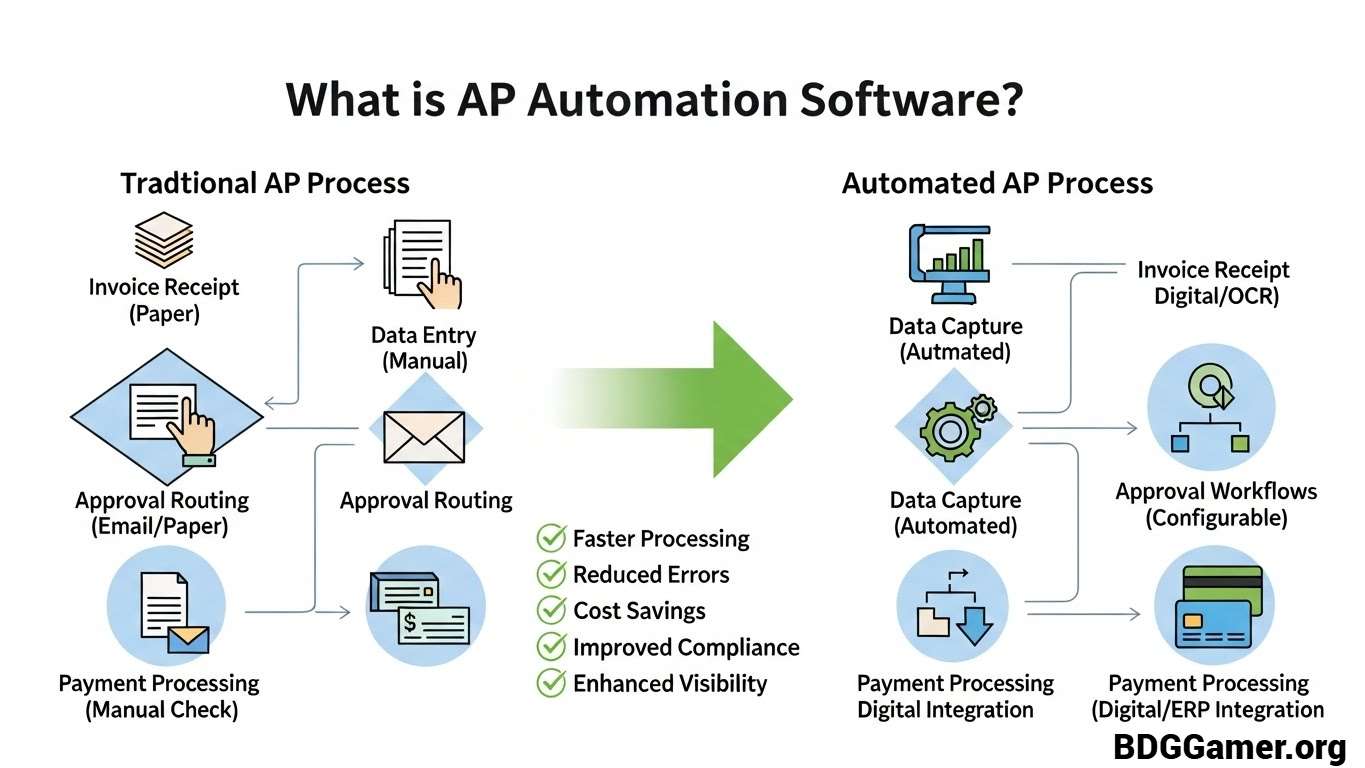

Manual AP processes often cause delays, lost invoices, and payment mistakes. This can hurt vendor relationships and lead to late fees.

With AP automation software, businesses gain better control, visibility, and speed. It reduces paperwork and improves accuracy.

Key Features of AP Automation Software

Here are the most useful features that make AP automation software powerful:

Invoice Capture

The software scans and reads invoice details automatically.

Approval Workflows

Invoices move digitally from one approver to another.

Payment Scheduling

Payments are planned based on due dates.

Vendor Management

All vendor records are stored safely in one place.

Real-Time Tracking

Finance teams can see invoice status instantly.

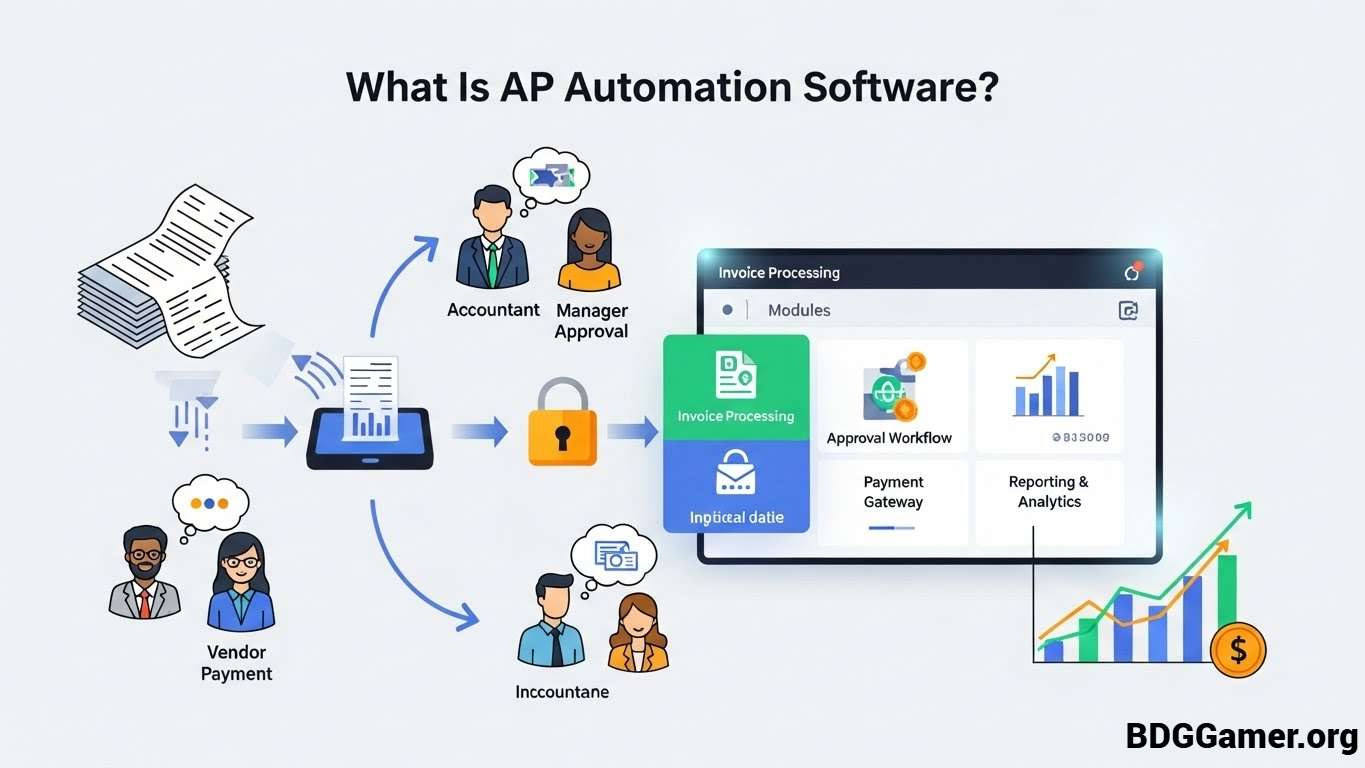

How AP Automation Software Works

Let’s understand the process in simple steps:

- Invoice is received digitally

- Software reads and stores the data

- Invoice is matched with purchase order

- Approval request is sent automatically

- Payment is scheduled

- Records are stored for audits

This automated flow makes the process smooth and error-free.

Benefits of Using AP Automation Software

Faster Processing

Invoices are approved and paid quickly.

Reduced Errors

Automatic data capture lowers manual mistakes.

Lower Costs

Less paper, fewer delays, and reduced labor cost.

Better Vendor Relationships

On-time payments improve trust.

Easy Compliance

Digital records simplify audits.

AP Automation Software for Small Businesses

Small businesses often struggle with limited staff and time. AP automation software helps by:

- Reducing manual work

- Improving cash flow visibility

- Making payments simple

- Keeping vendor data organized

It allows small teams to manage finances like large companies.

AP Automation Software for Medium Businesses

Medium-sized companies use AP automation software to:

- Manage higher invoice volume

- Maintain accurate approvals

- Track spending

- Improve budgeting

It provides structure and financial clarity.

AP Automation Software for Large Enterprises

Large companies benefit by:

- Handling thousands of invoices easily

- Managing multi-location approvals

- Improving compliance

- Enhancing reporting and analytics

Security Features in AP Automation Software

Security is very important in financial systems. Most AP automation software offers:

- Encrypted data storage

- User access controls

- Activity logs

- Fraud detection tools

This keeps financial data protected.

How AP Automation Software Improves Cash Flow

Good cash flow keeps businesses healthy. AP automation software helps by:

- Preventing late fees

- Avoiding duplicate payments

- Offering real-time spending visibility

- Supporting better budgeting

Common Challenges Solved by AP Automation Software

Lost Invoices

All invoices are stored digitally.

Late Payments

Automated reminders prevent delays.

Duplicate Payments

System checks avoid repeated payments.

Manual Errors

Automatic data capture ensures accuracy.

How to Choose the Right AP Automation Software

When selecting the best AP automation software, consider:

- Business size

- Monthly invoice volume

- Approval structure

- Reporting needs

- Budget

Testing a demo version is always helpful.

Industry Use Cases

AP automation software is widely used in:

- Retail

- Manufacturing

- Healthcare

- Education

- Technology

- Construction

Every industry benefits from organized and automated payments.

Future of AP Automation Software

The future looks bright. Upcoming improvements include:

- Smarter AI invoice scanning

- Predictive cash flow planning

- Real-time vendor communication

- Faster global payments

These upgrades will make AP automation software even more powerful.

Conclusion:

Managing payments manually is no longer practical in today’s fast business world. AP automation software simplifies accounts payable processes, saves time, reduces costs, and improves accuracy.

Whether you run a small startup or a large enterprise, using AP automation software helps your business stay organized, reliable, and financially strong.

Switching to AP automation software is not just a smart move—it is a necessary step for business growth in the digital age.